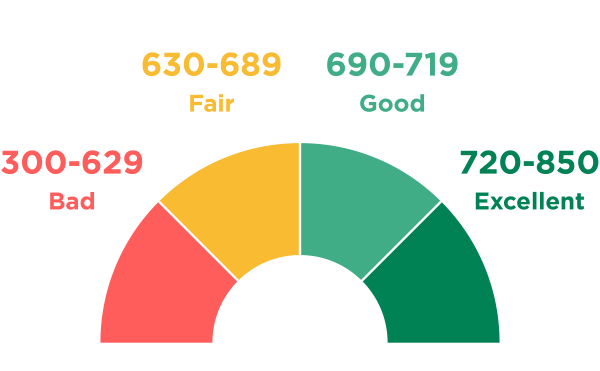

What’s A Good Credit Score?

On the most commonly used scale by FICO credit scores can range anywhere from 300-850. Mortgage companies, credit cards, and lenders all have different standards what they consider to be good credit, but good credit can generally be considered anything higher than 690. They consider information like if you’ve had any late payments and how much debt you carry (credit utilization). If you find your credit score to be less than desirable contact Powerhouse Consultants and find out how you can gain your financial freedom in no time.

What Are the Benefits of a Good Credit Score?

A good credit score can have a major effect on your interest rates whenever you buy a car or home, take out a loan, or even applying for rental housing and a car lease. In some parts of the country it can also effect how much you pay for car insurance. Don’t know what your credit score is? Find out here.

How Do I Get A Higher Credit Score?

- Pay bills on time. Late payments can lower your score.

- Stay well below your credit limit.

- Keep your credit accounts open.

- Don’t apply for too many credit cards at once.

- Dispute negative reports.

Even if you have made these mistakes, Powerhouse Consultants can help you remove negative accounts from your report and help you reach your highest credit potential. We can even help you remove bankruptcies, civil judgements, and student loans.